Explore your future with Brightwell.

Brightwell is the primary service provider providing fiduciary management services, member services, operational and secretariat services to the £37bn BT Pension Scheme (BTPS), one of the largest private sector pension schemes in the UK with c.260,000 members.

Brightwell also provides fiduciary management services to the defined benefit section of the EE Pension Scheme (EEPS) which has c.£1bn AUM and 8,000 members and is the administrator for the Mineworkers’ Pension Scheme (MPS) which has c.6,000 deferred members and 110,000 pensioners in payment.

Brightwell provides a wealth of opportunities across a wide range of roles for our people to learn, grow and develop, working in partnership with our clients to solve the complex challenges they face.

Brightwell are looking for those who share our values and want to be a part of a dynamic and inclusive organisation passionate about shaping the future of pension management.

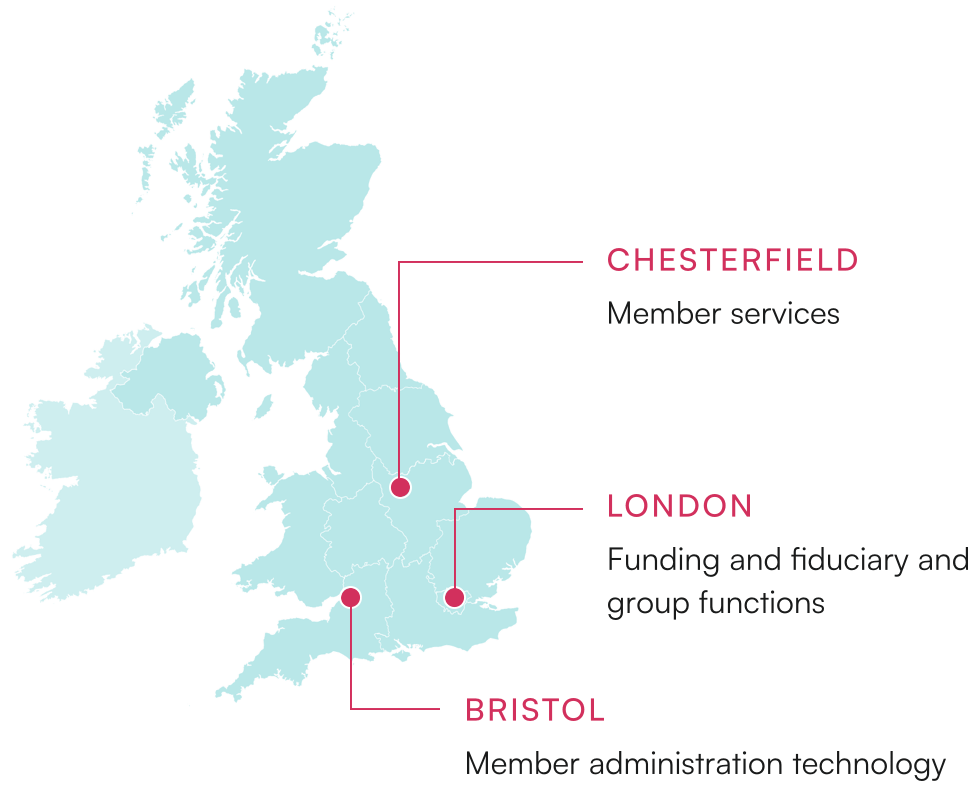

We operate across three locations within the UK

Who We Are

Brightwell specialise in providing comprehensive pension management services supporting over 382,000 members and £37bn in AuM.

Our values

Our values are key in inspiring colleagues’ best efforts; setting appropriate workplace behaviour and building a culture we are all proud of.

Vacancies

Pensions Finance Administrator

Salaried – Venture House, Chesterfield, S41 8NR, United Kingdom

Join Our Team as a Pensions Finance Administrator

Location: Chesterfield, Derbyshire

Are you passionate about Finance and providing high-quality service? Would you be keen to work in an exciting, growing, award-winning business in a highly supportive environment? If so, we want to hear from you! Due to growth and demand across our new and existing clients, we are seeking a Finance Administrator to join our Dynamic team.

This role is a pivotal part of the finance team, responsible for maintaining and processing a wide range of financial transactions within the general accounting framework. You will focus on the pensions area of our clients, ensuring accuracy, compliance, and timely execution of all related activities.

What you’ll do:

Manage daily financial tasks, including preparing funding calculations, processing payments, posting journals, and maintaining accurate client bank accounts.

Perform regular ledger, bank, PAYE, and AVC reconciliations, resolving any discrepancies and ensuring compliance with internal controls.

Handle scheme contributions, monthly court orders, voluntary deductions, and other time‑sensitive payroll‑linked processes.

Analyse scheme transactions and prepare monthly client accounting packs, as well as quarterly and annual client deliverables.

Review and quality‑check team processes, emails, and outputs to ensure accuracy and consistency.

Liaise with third parties, support system testing, and help maintain clear client‑specific work instructions.

Contribute to team development by assisting with on‑the‑job training and supporting additional tasks across the wider function.

This role would suit someone with:

Experience in an accounts function

Experience of journals and reconciliations

Excellent knowledge of Microsoft Office particularly Excel and Word

Knowledge of general office procedures

Strong interpersonal, communication (oral and written) and organisational skills

Ability to produce accurate reporting and show strong levels of attention to detail

Other prerequisite skills, including numeracy and literacy

The ability to work to deadlines and manage workload appropriately

AAT part qualified is desired but not essential

Exercise initiative, lateral thinking and flexibility and propose practical, realistic recommendations

Team player

Why Brightwell?

As a Brightwell colleague, you will enjoy a competitive salary, hybrid work practices, professional development, career development, and a great benefits package including:

Annual performance bonus of up to 7%.

25 days holiday (increasing to 30 with service) plus bank holidays.

A pension with 15-17% employer contributions (depending on age).

8 x salary Life Insurance.

Generous family friendly policies, including up to 26 weeks full pay (maternity, adoption and paternity leave)

Free health assessments.

Health cash plan.

Professional study support.

Employee Assistance Programme and free Wellhub wellness network platform access.

Free on-site parking.

Building an inclusive work environment:

Brightwell is committed to developing and maintaining an inclusive culture, ensuring that behaviours, working practices, and policies promote fair treatment and access to development opportunities for every colleague. We value the benefits a diverse workforce can bring and want Brightwell to be a place where all colleagues can thrive, feel that they belong, are valued, and contribute to our success. This is underpinned by Brightwell’s RISE corporate values: Responsible, Impactful, Supportive & Expert.

Academy Pensions Administrator

Salaried – Venture House, Chesterfield, S41 8NR, United Kingdom

Join our growing company with a multi-award winning training programme!

The Opportunity

Brightwell's Pensions Academy Training Programme will equip you with the knowledge, skills and experience to deliver a best-in-class administration service to our members, all in accordance with Brightwell’s service contracts and agreed administrative procedures. The programme will enable you to serve members confidently and competently, and administer a wide range of casework types, including transfers, retirements, data, and bereavements processes.

The Academy programme comprises the following four elements:

Route To Competency (RTC): Hands on learning groups of processes, with a “buddy”, enabling you to demonstrate successfully completing casework on your own.

Award in Pensions Essentials (APE): Dedicated training sessions to equip you with complementary knowledge and insight to achieve this Pensions Management Institute accredited qualification.

Pensions Technical: Dedicated training sessions focussing upon the technical pension’s knowledge and insight, including calculations, required for the pension scheme.

Leadership Development: You will participate in our soft skills development programme focusing on relationship building, active listening, change management, performance and coaching.

Offering a salary of £25,472, it takes approximately 9-12 months to complete the programme, during which time you will be office based Monday to Friday. Once you have been successfully signed off for all programme requirements, you will be promoted to the role of Pensions Administrator and your salary increased accordingly!

Who are we looking for?

We are looking for people who are ambitious, highly motivated to learn and commercially minded. Candidates must have a strong work ethic and high levels of numeracy, as well as an ability to work under pressure to achieve timescales without compromising quality.

Essential Experience/Skills/Attributes:

Strong communication skills, both written and verbal

Can do approach

Passionate about excellent customer service

Strong numeracy skills

Ability to work to deadlines

Basic IT skills (use of Microsoft office)

Good attention to detail

Ability to adapt to change in a fast-paced working environment

Desirable Experience/Skills

Maths and English GCSE (or equivalent qualification) at a high grade (5-9).

What should you expect in the process?

If shortlisted, you will be invited to attend a face-to-face interview, prior to your interview, you will be asked to undertake some basic research on a topic and to discuss your findings in the interview. You will also be asked to complete a 12-minute online cognitive assessment before the date of your interview (please note, this assessment is not an intelligence test and is used to help provide an indication of your ability to learn and problem solve).

If you require any particular arrangements in order to attend and/or participate in the assessment process, please include details with your application.

If you are successful, you will be enrolled onto the next Pensions Academy Training Programme intake and will start your career with Brightwell on 7th April 2026.

Brightwell

Brightwell's Pensions Academy Training Programme won the 2023 Learning, Development & Talent Retention Pinnacle Award hosted by the Pensions Management Institute and the 2023 Training Scheme of the Year hosted by the Professional Pension's Rising Star Awards.

We are the primary service provider providing fiduciary management services, member services, operational and secretariat services to the BT Pension Scheme (BTPS) and the complete pensions administration service to the Mineworkers Pensions Scheme (MPS) - two of the largest defined benefit pension schemes in the UK. Brightwell also provides fiduciary management services to the defined benefit section of the EE Pension Scheme (EEPS).

Why Brightwell?

As a Brightwell colleague, you will enjoy a competitive salary, hybrid work practices, professional development, career development, and a great benefits package including:

Annual performance bonus of 3 – 7%

25 days holiday (increasing to 30 with service) plus bank holidays.

A pension with 15-17% employer contributions (depending on age).

8 x salary Life Insurance.

Generous family friendly policies, including up to 26 weeks full pay (maternity, adoption and paternity leave)

Free health assessments.

Health cash plan.

Professional study support.

Employee Assistance Programme and free Wellhub wellness network platform access.

Free on-site parking.

Apply Now

Our Pensions Academy Training Programme is the ideal opportunity to develop new skills and experiences and to embark on a career in pensions administration.

Interim Group Data Readiness Project Manager (12 months)

Salaried – London, Cavendish Venues - 1 America Square, EC3, EC3N 2LB, United Kingdom

Brightwell Overview

Brightwell Group operates across the UK and North American pension markets, delivering a comprehensive suite of services that support defined benefit pension schemes. They provide pension administration software, third-party administration services, fiduciary management, administration consultancy, and secretariat services.

Procentia, a key part of the Brightwell Group, develops and delivers advanced pension administration software solutions. Its products are trusted by a wide range of multinational corporations and mid-sized businesses to manage their pension schemes efficiently. The business continues to grow in both scale and reputation.

The Membership Services business provides high-quality administration services to pension schemes and their partners. The largest of these is the BT Pension Scheme (BTPS), which manages approximately £37 billion in assets. This division is experiencing sustained growth and recognition for its service excellence.

Brightwell also delivers fiduciary management services to the defined benefit section of the EE Pension Scheme, which has approximately £1 billion in assets under management.

The Group employs over 350 professionals across offices in London, Chesterfield, Bristol and Chicago. They are deeply committed to fostering a diverse, inclusive, and equitable workplace culture—one that reflects the society they serve and empowering their people to thrive.

Role Overview

Purpose:

The Group CTO is sponsoring a first line Executive review of the Brightwell Group’s data readiness and controls. A high-level gap analysis has been completed, and a project is to be initiated across the various business units and entities, to close business and technology data gaps.

A 12-month project is to be mobilised and join up with local data projects, forums and activities to add momentum and coordination to the Group’s activities.

Key deliverables of the project

Working between the Group CTO and CRO, their teams and wider business teams, establish a data strategy approach and assess the need for a DPO.

Audit coverage of data policies and frameworks.

Assure alignment, embed data classification policies; enforce via digital tools for documents and emails.

Launch and embed new data definitions across group, including data quality, data governance, data architecture, data lifecycle and data accessibility.

Harmonise Group-wide policies, controls, and management.

Likely transition of DPIA completion to business units from a centralised activity.

Define and implement Group-wide data quality goals.

Implement business ownership and stewardship at the Saas business Procentia, including catalogue and lineage.

Develop business case and strategy for future-proofing data architecture across the Group.

Audit record retention schedules; automate retention and deletion and re-educate staff on data storage practices.

Standardise data access management controls.

Establish data lineage and data library controls, where not present, with business owners.

Dovetail the Group project activities with local data management forums.

Person Specification

Essential knowledge, skills and experience:

Proven experience in a senior focussed programmes and ideally data quality, management, storage and lifecycle projects.

Strong stakeholder management skills and previous experience of presenting and interacting at C Suite, SLT or Exco Level.

Experience in working through teams rather than having a team of their own.

An experienced verbal and written communicator, able to distil complex ideas to simple understandable views, for any audience.

Demonstrated success in developing and executing enterprise-wide activities across entities and differing cultures.

Strong track record in leading business and technology transformation projects.

Strong understanding of data protection, data management, and regulatory compliance frameworks, for example GDPR, ISO 27001 and SOC2.

Good understanding of Microsoft centric tools for managing, securing and storing data e.g Purview

Familiarity with financial services, pensions, or regulated industries (preferred but not essential).

Worked within and strong understanding of regulatory environments.

Certifications (preferred) and combination: CIPM/CIPP/E, CDMP, CISM, Prince2/Agile PM.

Personal Attributes

Collaborative and inclusive leadership style, with the ability to influence across functions.

Resilient, adaptable, and calm under pressure.

Results-oriented, with a strong focus on delivery and accountability.

An eye for detail; but not distracted by it.

Operates at pace and purpose.

High integrity and commitment to ethical standards and regulatory compliance.

Location and Travel

The role is expected to be London based (or Chesterfield if an internal candidate), with agreed remote hybrid working.

Travel to Bristol and Chesterfield offices will be expected.

Procentia have an office in Chicago. Travel to this office, for this role, is not required.

Diversity, Equity & Inclusion

Brightwell is committed to developing and maintaining an inclusive culture, ensuring that behaviours, working practices and policies promote fair treatment and access to development opportunities for every colleague. We value the benefits a diverse workforce can bring and want Brightwell to be a place where all colleagues can thrive, feel that they belong and are valued and contribute to our success. This is underpinned by Brightwell’s RISE corporate values: Responsible, Impactful, Supportive & Expert.

Our RISE Values

Our values guide our behaviour and are embedded throughout the organisation.

Responsible – we take individual responsibility for making things happen. We take ownership of the decisions we make. We never walk past a problem. We are both open and brave - supporting and challenging each other to resolve issues.

Impactful – we are driven to do all that we can to create a better future for our members. We recognise that the way we invest can benefit wider society. We constantly strive to make a difference.

Supportive – we work together across teams to deliver the best outcomes for members and wider society. We support each other when taking difficult decisions and are always respectful, thoughtful and helpful.

Expert – we set very high standards, constantly looking at how we can be better and bolder – whether serving members, improving how we work, or invest. We are constantly innovating – challenging ourselves to find new ideas. We use our commercial acumen to deliver value for members and wider society.

Client Operations Manager

Salaried – Venture House, Chesterfield, S41 8NR, United Kingdom

We are seeking a strategic and relationship-driven Client Operations Manager to join our Service Operations team in Chesterfield. The Client Operations Manager is responsible for managing a portfolio of pension clients, ensuring high-quality service delivery, and driving commercial growth. You’ll act as a key liaison between clients and internal teams, helping shape and enhance our product offering while ensuring client satisfaction and retention.

Key Responsibilities

- Manage relationships with a portfolio of pension clients, acting as the main point of contact at both strategic and tactical levels.

- Collaborate with internal teams to ensure client requirements are met and service levels are maintained.

- Support the development and presentation of proposals to new clients and identify opportunities for growth.

- Anticipate client concerns and manage expectations around operational performance and service changes.

- Lead client retention strategies and account development aligned with Brightwell’s growth agenda.

- Provide project and operational support to ensure client outcomes are achieved and exceeded.

- Oversee client reporting and support presentation of performance updates.

- Ensure compliance with governance frameworks and contractual obligations.

- Identify and implement solutions that meet stakeholder needs across the business.

- Acting as the day-to-day contact for client, ensuring timely and consistent responses.

Person Specification

We’re looking for a commercially aware professional with a proven track record in client relationship management, including senior stakeholder engagement. You’ll bring strong influencing and communication skills, experience in identifying and delivering service improvements, and the ability to operate effectively in a change-driven environment. Experience in the pensions industry, particularly in regulated settings, and familiarity with Requests for Proposal would be advantageous.

Pensions Administrator

Salaried – Venture House, Chesterfield, S41 8NR, United Kingdom

Are you passionate about pensions and thrive in a fast-paced environment? If so, we want to hear from you! Due to growth and our ongoing development plan, we are seeking experienced DB pension administrators to join our dynamic team.

What You’ll Do:

- Provide a best-in-class service to our pension scheme members, communicating with them both in writing and verbally, and processing casework accurately in accordance with scheme rules and pensions legislation

- Maintain our pensions administration systems and databases

- Proactively contribute to the team and share ideas for continuous improvement

- Document work processes and provide support to other members of the Member Services teams

- Assist in the implementation of new pension schemes and transitions

This Role Would Suit People Who Have:

- Experience administering a defined benefit pension scheme

- An up-to-date understanding of relevant UK pension legislation

- Excellent communication skills, with the ability to adapt their approach to different audiences and situations

- Strong IT and Microsoft Office skills, with a high level of attention to detail and accuracy

- Good organisation skills, with the ability to manage their own workload while supporting the team

Why Brightwell?

As a Brightwell colleague, you will enjoy a competitive salary, hybrid work practices, professional development in an award-winning supportive work environment, career development, and a great benefits package including:

- Annual performance bonus

- 25 days holiday (increasing to 30 with service) plus bank holidays

- A pension with up to 17% employer contributions (depending on age)

- 8 x salary Life Assurance

- Free health assessments

- Health cash plan

- Employee Assistance Programme and free Wellhub platform access

- Free on-site parking

Building an Inclusive Work Environment:

Brightwell is committed to developing and maintaining an inclusive culture, ensuring that behaviours, working practices, and policies promote fair treatment and access to development opportunities for every colleague. We value the benefits a diverse workforce can bring and want Brightwell to be a place where all colleagues can thrive, feel that they belong, are valued, and contribute to our success. This is underpinned by Brightwell’s RISE corporate values: Responsible, Impactful, Supportive & Expert.

Hear from a colleague

Hear from Katie about how her role helps to manage risk within Brightwell. Katie also speaks about her career journey with Brightwell and how she has been able to grow and develop her career as well as exploring a wealth of learning opportunities achieving formal qualifications.

Why Join Us

Careers Development

As Brightwell grows and develops we expect and support our people to be able to do so too. Whether you’re looking to enhance your skills, gain new qualifications or take your career to the next level, we provide the support and resources to help you succeed. Read below about our Pensions Academy Training Programme and Investment 20/20 to learn about just 2 of our projects that demonstrate our continuous learning culture.

Pensions Academy

Established in 2022, we developed the – now award-winning – Pensions Academy Training Programme to grow tomorrow’s experts in pensions administration. The programme uses a blended learning model aimed at nurturing and developing early careers within the pensions industry.

Our Academy accepts those from all walks of life with little or no pensions experience, but just a great attitude and willingness to learn.

Commitment to Diversity, Equity & Inclusion

At Brightwell we aim to enable everyone to perform to the best of their ability and this extends to our recruitment process. We strive to ensure that anyone considering a career with Brightwell are treated equitably and without prejudice through eliminating bias in our process. View How to Join Us to learn what to expect in our selection process.

Our Benefits

We believe that great work comes from happy and well-supported people. That’s why our benefits are carefully chosen to strike the balance between rewarding through compensation and supporting a diverse range of lifestyles. From competitive salaries to health & wellbeing subscriptions, smart working options and meaningful time-off, we ensure that you are not just rewarded for your work but also give the time to enjoy life outside of it.

Your Health

Our benefits provide you the opportunity to grow, protect and enjoy your wealth providing you with financial peace of mind. We offer a generous defined contribution pension scheme, life assurance and income protection policy that covers a range of long-term illness or injury. As well as financial security, we operate to ensure we are always offering competitive salaries and that our people are rewarded for their work.

Your Wealth

Financial wellbeing and security is just as important as your wellbeing. Our benefits provide you the opportunity to grow, protect and enjoy your wealth providing you with financial peace of mind. We offer a market-beating defined contribution pension scheme, generous life assurance and income protection that covers long-term illness or injury.

As well as financial security, we operate to ensure we are always offering competitive salaries and that our people are rewarded for their work. To do this we review salaries each year and offer a bonus dependent on an individual’s own performance and contributions.

Your Lifestyle

Life is more than just about work, it’s about enjoying your time outside of this too. Our benefits are selected to make everyday life smoother, more enjoyable and financially rewarding. Whether it’s looking for an affordable way to get a new car or peace of mind when travelling. We offer options for a salary sacrifice car-lease and cycle-to-work schemes, travel insurance subscription, options to donate to charity through payroll and subscriptions services for will writing and powers of attorney.

How to Join Us

We understand that talent comes from all walks of life, that’s why our recruitment process is built on fairness, transparency and objectivity.

What to Expect

We assess candidates based on skills, experience and knowledge required to succeed in the role. Our approach assesses candidates against key criteria of the role which allows us to manage bias.

Every step is designed to identify the best fit for both role and alignment to our RISE values. This may include a remote video link interview, in-person assessment, preparing and delivering a presentation, competency-based questioning and psychometric profiling.

We are committed to ensuring that everyone is provided with the opportunity to present their best self – removing any barriers and accommodating adjustments in the process where necessary – helping us to build diverse, dynamic, and inclusive teams.

Interview Tips

We understand that interviews can be a nerve-wracking experience, and so we want to share tips with you to enable a constructive and pleasant experience when you interview at Brightwell.

We structure our interviews and assessments to best assess candidates against the requirements of the role they are applying for, as well as our values. Prepare yourself by studying our website and analysing the role profile.

We recommend that you also bring anything with you that will help support your interview. This may be bringing in a copy of your own CV to refer to, a list of your career achievements to talk about, or even a list of prepared examples that you might want to refer to should a relevant question be asked.

When giving your answers to questions, you can give them clearly and in a structured manner by utilising the STAR technique:

- Situation – explain what the situation/background is

- Task – explain what action needed to be taken

- Action – explain further what steps you took and how you completed the task

- Result – share the results of your work, let us know what you achieved and what you learned

Interviews are a 2-way process and so we appreciate that your interview is also an opportunity to assess whether Brightwell is the right career choice for you too! Be sure to ask any questions you’d like to have answers to.

Commonly asked questions

We know that there can be a lot to think about when considering applying for a new role or preparing for an interview, so that you can spend more time preparing your application, we have provided some questions and answers below that you may have had.

Where will I be interviewed?

Your interviews may be held remotely via Microsoft Teams or on-site at one of our offices in London or Chesterfield. At least one of your interviews will be at one of our offices. This gives us a chance to meet each other in person and for you also to view the office where you may be based if successful.

Who will I be interviewed by?

You will be interviewed by those appropriate to assess your application against the requirements of the role. We operate on a method to reduce bias in interviews and therefore you will be interviewed by at least two people, of which one may be a member of the HR team.

When should I expect to hear back?

When you hear back may depend on the approach to hiring for the role. It is best to ask in your interview when you can expect to hear back.

Will I get feedback if I’m not successful?

If you are unsuccessful in your application, you will be informed of the outcome. However, we do not guarantee that feedback on your application will be provided.

I applied before but was unsuccessful, can I apply again?

Our vacancies are open to all who wish to apply. Our interviews are structured to best assess candidates against the requirements of the role as well as our values. You are welcome to re-apply for a vacancy if you believe you have the skills, experience and knowledge to fulfil the duties of the role.

I require adjustments for my interview, who do I speak to?

We endeavour to make sure all applicants have the best opportunity to represent themselves in interview, if you need any adjustments for your interview please let the organiser, usually a member of the HR team, know, on receipt of your interview confirmation

I am interested in Brightwell but there are no suitable jobs. Can I apply speculatively?

We do not accept speculative applications. We encourage you to periodically check our vacancies page for roles that may be of interest to you.